Investment Banking Resume Templates and Guide

Published on October 2nd, 2024

Investment banking is among the few sought-after positions in the finance industry, offering promisingly high rewards and dynamic work environments where one can work towards growth on both a personal and professional level. With that said, it's extremely competitive, and among the best tools that will set you apart from the rest of the crowd is a well-crafted investment banking resume.

So, be it an entry-level graduate looking to become an analyst or an experienced professional looking to rise to the senior level, a resume is your passport to entering the interview room. This blog explores key elements and strategies on how to format this resume in such a way that catches the eye of recruiters and hiring managers.

Understanding the Purpose of an Investment Banking Resume

But before explaining what a good resume looks like, first, it must be known: what is the purpose of a resume? Your investment banking resume should ideally summarize your experience, skills, and education in such a concise but impactful way that you convey the value to your future employers.

Investment bankers typically glance over resumes in 30 seconds, searching for specific keywords, accomplishments, and relevant experience. They don't need fluff-they want results, technical expertise, and evidence you can handle the high-pressure environment of investment banking. Understandably, every line counts to bring value to your resume.

Check out the free resume templates for investment banking resumes.

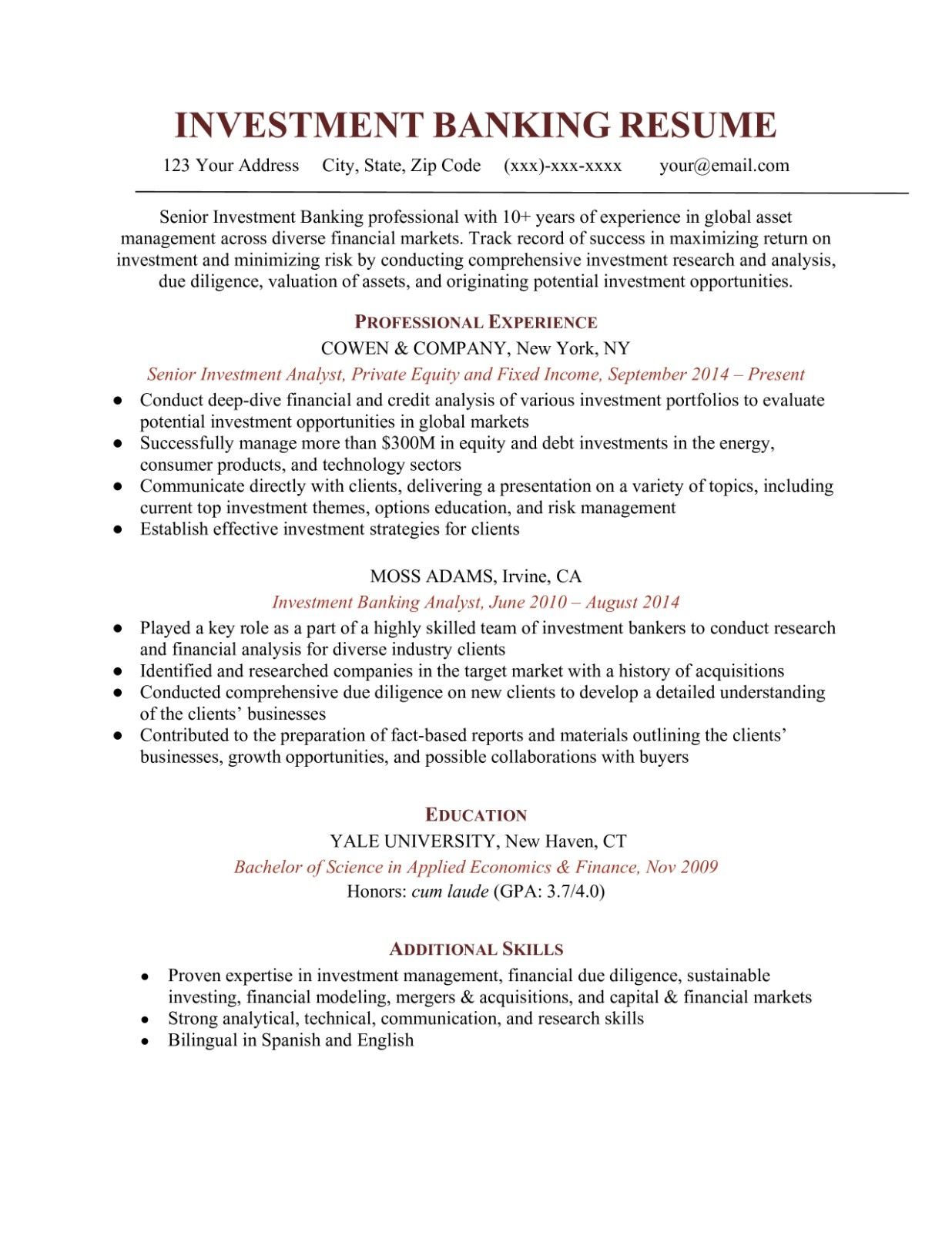

Template 1

Investments Banking Resume Format

Investment banking resumes should be typed uniformly. By following the standard industrial format, you are guaranteed to check all the boxes of the recruiter:

Header

Write your name, contact details, LinkedIn profile, and other professional certifications at the very top of the page.

Summary

Write a brief statement that summarizes your professional experience and goals. Not required but it will act as a great quick pitch for the candidacy.

Education

Mostly this section is at the top for fresh graduates and analysts. Put in your university, degree, your very good GPA if you have one, and any coursework being particularly relevant.

Experience

This will be the meat of your resume and should be on your most relevant internships, jobs, or projects.

Skills: These can sometimes be given a special section. You will be pointing out the technical skills such as financial modeling, and data analysis, proficient on tools like Excel, PowerPoint, or Bloomberg.

Interests

For junior applicants, extracurricular activities or interests are a great way to differentiate you from the competition.

Investment Banking Resume: Section by Section

Header

Your name is often the biggest text size on a resume. Include your telephone number, email address, and LinkedIn profile URL. Always update LinkedIn as it should reflect what you have on your resume. Avoid including information such as your full home address, and for professionalism, keep your email clean or include your name.

Professional Summary

Professional summary. A professional summary is a short, punchy paragraph that distills the key points of your career. It's not commonly required, but it can be helpful to capture someone's attention right away-that is, if you are a career changer or have many years of experience. Try to keep it to 2-3 sentences:

Example:

"Highly motivated graduate in finance with extensive experience in financial modeling, valuation, and M&A analysis. Seeks an analyst position to utilize my quantitative skills and passion for market analysis in a dynamic investment banking team."

Education

For junior candidates, this will be the most important section. Always include:

- Name of University

- Degree, e.g., Bachelor of Science in Finance, Economics, Accounting.

- Date of graduation

- GPA if it's 3.5 or higher

Relevant courses

Investment Banking, Corporate Finance, Financial Modeling

Certifications: Some certifications, such as CFA Level I (or progress toward it), Financial Modeling courses, or others.

For the more experienced candidate, education will be secondary in importance to his or her experience. Still, if you do have impressive academic experiences, such as graduating at the top of the class, serving in a leadership role of a club related to finance, and other similar items that are distinct indicators of success, be sure to include these experiences.

Experience

Shine in experience. This is not a list of job titles; it is an opportunity to show how you made an impact in your previous roles. Use quantifiable accomplishments to prove your abilities:

Example:

Internship, Investment Banking Goldman Sachs New York, NY May 2023 – August 2023

Developed financial models for a potential M&A deal, DCF, and LBO analysis that successfully closed a $200M deal.

Conducted market research and trend analyses for industries and counseled senior bankers to use which growth strategies

Helped prepare pitch books and presentations which resulted in increasing client acquisition by 15%

Note:

- Use "action words" such as "developed," "analyzed," "led," and "coordinated."

- Quantify your results: For example, revenue growth, cost reduction, or deal size.

- Tailor your experience for the job you are applying for. In other words, tailor it to relevant projects or skills.

Add your Skills

Investment banking is a technical field, and recruiters want to see that you have the right hard skills. In this section, bring out the following:

Technical skills

Financial modeling

Valuation

M&A

LBO analysis

DCF analysis.

Software skills

Excel- with emphasis on pivot tables and macros; PowerPoint-include pitch decks; Bloomberg Terminal; Capital IQ; etc.

Language and Soft skills

- The ability to speak as many other languages as possible. For a global banking role, this would be an absolute plus.

- Soft skills such as communication and teamwork should form part of your experience but will not be listed here.

List Your Certifications and Training

It's terrific to remain in the field, especially for an industry as competitive as investment banking. If you're studying for or have already received a CFA (Chartered Financial Analyst) degree, this will be a great complement.

Some Examples:

Financial Modeling & Valuation Analyst (FMVA)

Chartered Alternative Investment Analyst (CAIA)

Extra-curriculars/Interests

If you are applying as a junior, the section on extracurriculars and interests may serve to demonstrate that you are the entire package, especially if you hold a leadership position in some type of financial club participated in investment competitions, or did other personal projects such as maintaining a portfolio of stocks.

Example:

- President, Finance Club: Organized workshops in financial modeling and networking events with industry professionals.

- Competitive chess, skiing, and some blogs on market analysis. Unless you are an experienced candidate and can justify skipping these, do not skip this section if you have some particularly relevant extracurricular activities that tie into your professional life.

Hitting on the tailored resume for every position

Beyond these, the secret to success in investment banking lies in tailoring that resume to the particular job or company you are applying for. The structure of your resume may well remain the same; however, the content will be adapted based on:

Specific Skills or Experiences Highlighted in the Job Description

- Some firms are traditional and old-fashioned, while others thrive on creativity and innovation. So, align your experiences according to the job description.

- Highlight any industry-specific work, like healthcare, technology, or energy if the role is focused on one of those sectors.

Formatting Tips: Keep it Clean and Professional

Besides what you're writing, your resume's format is almost as important. With investment banking, recruiters favor a simple yet professional design. To give your resume an easy, here are some tips.

- Font: Use 10-12 points for regular text and your name in 14-16.

- Margins: Make your content easy to read with half-inch or one-inch margins.

- Bullet points: Bullet your experience for easy readability.

- Length: Have your resume to one page—investment banking recruiters won't read past it.

Common Errors to Avoid

- Avoid these major common resume mistakes for greater chances of success.

- Overload of jargon: Be clear and brief.

- Typos or grammatical errors: Proofread several times or ask a friend to do it for you.

- Unrelevant information: Eliminate job experience or qualifications with no value contribution.

Conclusion

A stellar investment banking resume requires excellent attention to detail as well as strategic presentation of skills and emphasis on measurable results. Whether a graduate or experienced professional, fitting the right structure and tailoring it for the respective role will give you a long way ahead in landing that dream interview and taking the next step in your career ladder in investment banking.

Authors

Yash Chaudhari

With a strong background as an SEO and Content Specialist, Yash excels in driving organic traffic, improving search engine rankings, and creating SEO-optimized content. He has a proven track record of implementing strategies that increase website traffic and conversions. Additionally, Yash is an automotive enthusiast and has a keen interest in astronomy.

Hire the best without stress

Ask us how

Never Miss The Updates

We cover all recruitment, talent analytics, L&D, DEI, pre-employment, candidate screening, and hiring tools. Join our force & subscribe now!

Stay On Top Of Everything In HR