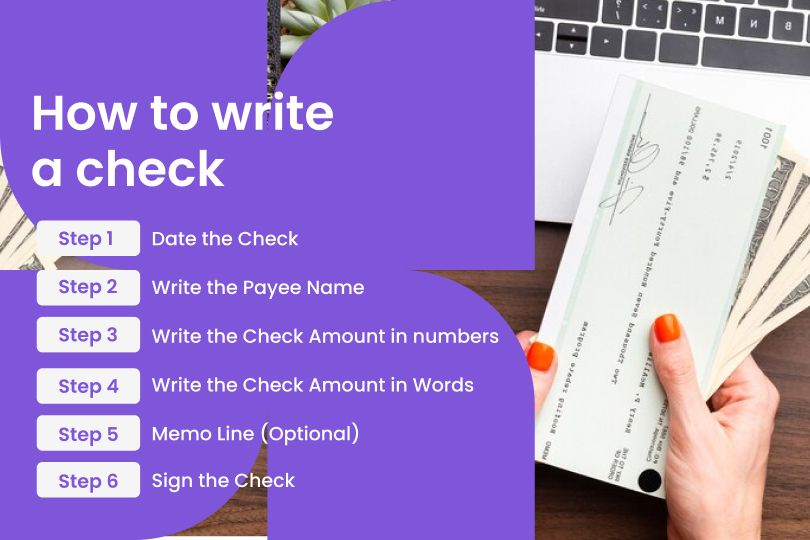

How to write a check

Published on July 2nd, 2024

What is a Check?

A check is a written, dated, and signed instrument that directs a bank to pay a specific amount of money to the bearer. Checks are a traditional form of payment that allows individuals and businesses to transfer funds without the need for cash. They serve as a tangible record of payment and can be used in various financial transactions, from paying rent to making charitable donations.

Definition and Purpose

At its core, a check is a written promise to pay the specified amount from the writer's checking account to the person or entity named on the check. This makes it a convenient and secure way to handle payments, especially for those who prefer not to carry large amounts of cash. Checks also provide a paper trail, which is useful for record-keeping and financial management.

Types of Checks

There are several types of checks, each serving different purposes:

- Personal Checks: These are the most common type of checks used by individuals for everyday transactions. Personal checks come pre-printed with the account holder's name, address, and bank information.

- Cashier’s Checks: Issued by a bank and guaranteed by the bank's funds, cashier’s checks are often used for large transactions, such as purchasing a car or making a down payment on a house. They offer a higher level of security since the bank guarantees the payment.

- Certified Checks: Similar to cashier’s checks, certified checks are guaranteed by the bank but are drawn on the account holder's personal account. The bank certifies that the funds are available and sets them aside until the check is cashed.

- Money Orders: Money orders are a prepaid form of payment, often used when a person doesn’t have a checking account. They can be purchased at various locations, including post offices, convenience stores, and banks.

Why Use Checks?

Despite the rise of electronic payment methods, checks remain popular for several reasons. They are particularly useful in situations where electronic payments are not possible or preferred. For instance, some landlords and small businesses may prefer checks due to the lower transaction fees compared to credit card payments. Additionally, checks can be postdated, which allows for future payments to be scheduled.

Checks also offer a level of personal control over payments. Unlike automatic electronic payments, writing a check requires the payer to actively authorize each transaction, providing an extra layer of security. Furthermore, the physical act of writing a check can serve as a reminder of the expense, helping individuals manage their budgets more effectively.

The Evolution of Checks

Historically, checks have been a cornerstone of the banking industry. The earliest forms of checks date back to ancient civilizations, where they were used as written orders for the transfer of funds. Over time, checks have evolved to include various security features such as watermarks, microprinting, and special inks to prevent fraud.

By understanding what a check is and its various forms, individuals can better appreciate this enduring financial tool and make informed decisions about when and how to use it. This foundational knowledge will also make the process of writing a check much easier and more intuitive.

Transitioning into the next section, we'll explore specific situations where checks might be needed and why they remain a valuable payment method in certain scenarios.

When and Why You Might Need to Write a Check

While digital payment methods have become increasingly popular, there are still numerous situations where writing a check is necessary or advantageous. Understanding when and why you might need to write a check can help you make informed financial decisions and maintain versatility in your payment options.

Situations Requiring a Check

- Rent Payments: Many landlords prefer or require rent payments by check, especially for long-term leases. Writing a check for rent ensures that there is a clear paper trail, making it easier to manage and document monthly expenses.

- Large Purchases: For substantial purchases such as buying a car, furniture, or other high-value items, using a cashier’s check or certified check can be more secure than carrying large amounts of cash. These checks are guaranteed by the bank, providing assurance to the seller that the funds are available.

- Donations and Charitable Contributions: Many charitable organizations accept checks for donations. Writing a check allows for better record-keeping and can be essential for tax deduction purposes. It also ensures that the entire donation amount goes to the charity, avoiding credit card processing fees.

- Gifts: Checks are a popular gift option for occasions like weddings, birthdays, and graduations. They provide a flexible form of monetary gift that the recipient can use as they see fit.

- Paying Bills: While many utilities and service providers accept electronic payments, some smaller companies or local service providers may prefer checks. Writing a check can also help you avoid the convenience fees sometimes associated with credit card payments.

- Reimbursing Friends or Family: For personal transactions, such as splitting a dinner bill or paying back a friend for a shared expense, checks can be a straightforward way to transfer money without needing electronic banking apps.

Advantages of Writing Checks

- Security and Control: Writing a check requires your active authorization, which can reduce the risk of unauthorized transactions. Checks also come with security features like watermarks and special inks that make them difficult to counterfeit.

- Record-Keeping: Checks provide a physical record of your transactions. Each check you write leaves a paper trail, which can be invaluable for budgeting and tax purposes. Many people use the memo line on checks to note the purpose of the payment, making it easier to track expenses.

- Proof of Payment: A canceled check serves as proof of payment. This can be particularly useful in disputes over whether a bill or debt was paid. Having a physical document that shows the transaction details can provide clarity and resolve misunderstandings.

- No Need for Internet Access: Writing a check does not require internet access or electronic devices, making it a reliable payment method in areas with poor connectivity or for those who prefer not to use online banking.

- Flexibility: Checks can be written for any amount and to any individual or business that accepts them. This flexibility is particularly useful when dealing with service providers who may not have the infrastructure for electronic payments.

Statistics and Trends

Despite the rise of electronic payment methods, checks remain a significant part of the financial landscape. According to a 2019 Federal Reserve study, Americans wrote 14.5 billion checks in 2018, amounting to $26.8 trillion in transactions. This indicates that while digital payments are growing, checks still play a crucial role in the economy, especially for certain demographics and transaction types.

Having explored the various situations where checks are essential and their advantages, the next step is understanding the practicalities of writing a check. In the following section, we will provide a detailed, step-by-step guide on how to write a check correctly, ensuring your transactions are processed smoothly and securely.

How to Write a Check: Step-by-Step Guide

Writing a check may seem straightforward, but it is crucial to follow each step carefully to ensure the check is processed correctly and securely. Here’s a detailed, step-by-step guide on how to write a check properly.

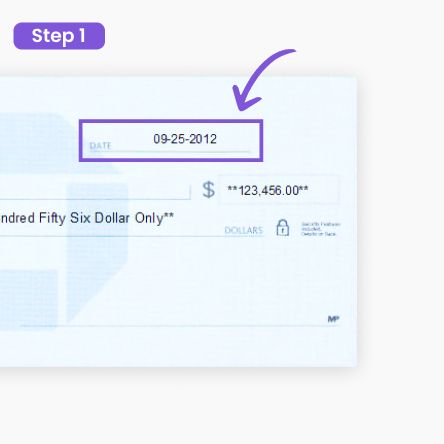

Step 1: Date the Check

The first step in writing a check is to date it. Write the current date on the line in the top right-hand corner of the check. The standard format is MM/DD/YYYY. For example, if today’s date is July 2, 2024, you would write 07/02/2024. The date ensures that the check is valid and provides a timeline for both the payer and the payee.

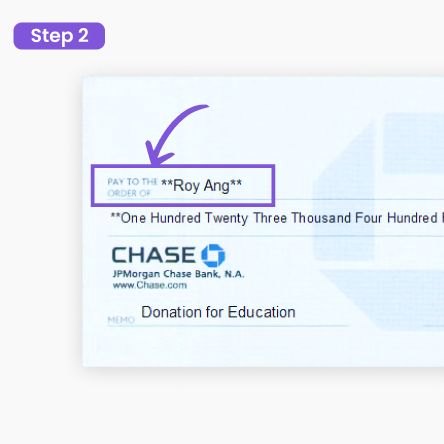

Step 2: Write the Payee Name

Next, write the name of the person or organization you are paying on the line that says “Pay to the Order of.” Ensure the name is spelled correctly and clearly. If you are unsure of the exact name, verify it to avoid any issues with the check being cashed. This step is crucial for directing the funds to the right recipient.

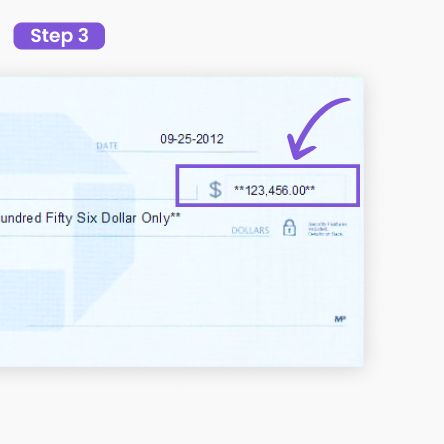

Step 3: Write the Check Amount in Numbers

In the small box on the right-hand side of the check, write the amount of the check in numbers. Be sure to include both dollars and cents. For example, if you are writing a check for twenty-five dollars and seventy-five cents, you would write “25.75.” Ensure the numbers are written clearly and close to the dollar sign to prevent any alterations.

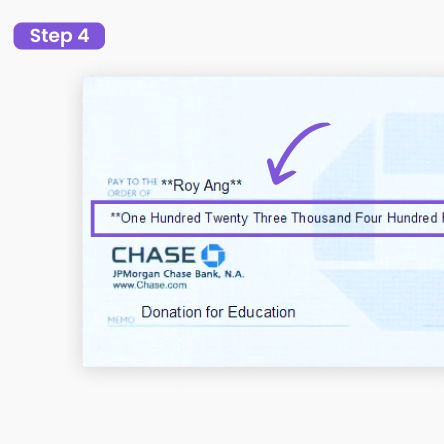

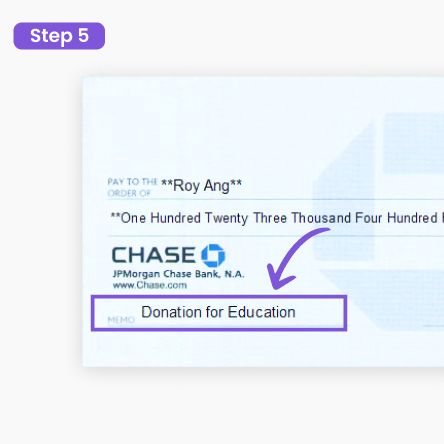

Step 4: Write the Check Amount in Words

On the line below the payee name, write out the check amount in words. This helps prevent fraud and ensures there is no ambiguity about the payment amount. For example, for $25.75, you would write “Twenty-five and 75/100.” Draw a line through any remaining space on this line to prevent any unauthorized changes.

Step 5: Fill in the Memo Line (Optional)

The memo line in the bottom left corner of the check is optional, but it can be helpful for record-keeping purposes. You can note the reason for the payment or any other information that will help you or the recipient understand the transaction. For instance, you might write “July Rent” or “Invoice #1234.”

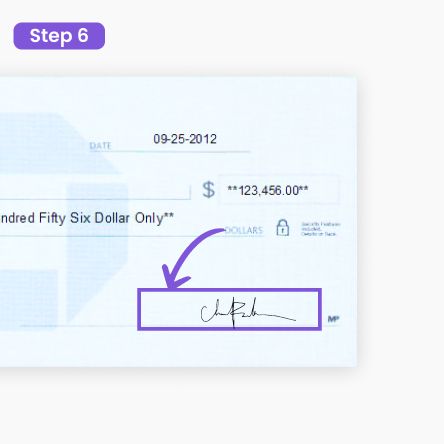

Step 6: Sign the Check

Finally, sign the check on the line in the bottom right-hand corner. Use the same signature that the bank has on file for your account. Your signature authorizes the bank to process the check and withdraw the funds from your account. Without a signature, the check is invalid and cannot be cashed.

Now that you have mastered the step-by-step process of writing a check, it is also important to consider additional tips and best practices to ensure your checks are secure and properly managed. In the following section, we will provide essential tips and considerations to keep your check-writing process smooth and secure.

Additional Tips and Considerations

Writing a check is more than just filling in the required fields. Ensuring accuracy, security, and proper record-keeping can help you avoid potential issues. Here are some additional tips and considerations to keep in mind when writing checks.

Tip 1: Keeping Track of Check Numbers

Importance of Sequential Numbering

Each check in your checkbook is pre-numbered, and using them in sequential order is crucial for effective record-keeping. Sequential numbering helps you track all the checks you have written and identify any missing or fraudulent checks easily.

Why It Matters for Record-Keeping

By maintaining the sequence of check numbers, you can quickly reference your bank statements and reconcile your account balances. This practice simplifies the auditing process and ensures you have a complete history of all your transactions. If a check is misplaced or goes missing, you can identify the missing check by its number and take appropriate action.

Tip 2: Security Measures

How to Protect Your Checks from Fraud

Check fraud is a significant concern, but following a few security measures can help mitigate the risk. Always use a permanent ink pen, preferably black or blue, to write your checks. This makes it difficult for anyone to alter the information. Avoid leaving blank spaces on the check by drawing lines through unused sections, such as the amount line if it doesn’t take up the full space.

Common Security Practices

Store your checkbook in a secure location, and never carry blank checks in your wallet. Regularly monitor your bank statements and online banking account for any unauthorized transactions. If you notice any discrepancies, report them to your bank immediately. Additionally, consider using checks with built-in security features such as watermarks, microprinting, and special inks that prevent duplication and tampering.

Tip 3: Alternative Payment Methods

Brief Overview of Electronic Payments

While checks remain a reliable payment method, electronic payments offer a convenient alternative. Online banking, mobile payment apps, and electronic funds transfers (EFT) are some of the options available. These methods provide instant transfers and can be more efficient for both payer and payee.

When Checks Might Still Be Preferred

Despite the advantages of electronic payments, checks are sometimes preferred for their tangible record and personal touch. For example, writing a check for rent payments can provide a physical receipt for both landlord and tenant. Additionally, some small businesses and service providers may not accept electronic payments, making checks a necessary option.

In conclusion, while modern digital payment methods are becoming more prevalent, the traditional check remains a valuable tool for many financial transactions. By understanding the step-by-step process of writing a check and adhering to additional tips for security and record-keeping, you can confidently manage your finances. Always ensure to keep track of your check numbers, implement security measures to prevent fraud, and consider when checks are the most appropriate payment method. With these practices, you can enjoy the flexibility and reliability that checks offer.

FAQ: How to write a check

How to write 800 on a check?

For an $800 check, write “800.00” in the numerical box and “Eight hundred and 00/100” on the line below the payee’s name.

How to write a check for 500 dollars?

For a $500 check, write “500.00” in the numerical box and “Five hundred and 00/100” on the line below the payee’s name.

How to write 0 cents on a check?

When there are no cents, write the amount as a whole number in the numerical box (e.g., 50.00) and write the amount in words followed by “and 00/100” (e.g., Fifty and 00/100).

How to write a check for $200?

For a $200 check, write “200.00” in the numerical box and “Two hundred and 00/100” on the line below the payee’s name.

How to write zero cents on a check?

For zero cents, write the amount in the numerical box (e.g., 100.00) and write out the amount in words followed by “and 00/100” (e.g., One hundred and 00/100).

How to write 1200 on a check?

For a $1200 check, write “1200.00” in the numerical box and “One thousand two hundred and 00/100” on the line below the payee’s name.

How to write out a check with cents?

To write out a check with cents, write the amount in numbers in the numerical box (e.g., 123.45) and in words on the line below (e.g., One hundred twenty-three and 45/100).

How do you write a check to yourself?

To write a check to yourself, enter your own name in the "Pay to the Order of" line, fill in the date, amount in numbers, amount in words, and sign the check.

How to write a check for 1200?

For a $1200 check, write “1200.00” in the numerical box and “One thousand two hundred and 00/100” on the line below the payee’s name.

How to write a check for 400 dollars?

For a $400 check, write “400.00” in the numerical box and “Four hundred and 00/100” on the line below the payee’s name.

How to write a check to IRS?

To write a check to the IRS, make it payable to “United States Treasury,” include your Social Security number, the tax year, and the form number (e.g., 1040) on the memo line.

How to write 50 dollars on a check?

For a $50 check, write “50.00” in the numerical box and “Fifty and 00/100” on the line below the payee’s name.

How to write 300 on a check?

For a $300 check, write “300.00” in the numerical box and “Three hundred and 00/100” on the line below the payee’s name.

How to write 1300 on a check?

For a $1300 check, write “1300.00” in the numerical box and “One thousand three hundred and 00/100” on the line below the payee’s name.

How to write a check for $1000?

For a $1000 check, write “1000.00” in the numerical box and “One thousand and 00/100” on the line below the payee’s name.

How to write a Wells Fargo check?

To write a Wells Fargo check, fill in the date, payee’s name, amount in numbers, amount in words, memo line (optional), and sign the check.

How to write a check for passport?

To write a check for a passport, make it payable to the U.S. Department of State, include the appropriate fee amount in numbers and words, and write a memo indicating it’s for a passport application.

How to write a check in words?

Writing a check in words involves writing the dollar amount in words followed by the cents as a fraction. For example, $150.25 would be written as “One hundred fifty and 25/100.”

How to write a rent check?

To write a rent check, make it payable to your landlord’s name, fill in the date, rent amount in numbers and words, and note the rental period in the memo line.

How to write a check for 1000 dollars?

For a $1000 check, write “1000.00” in the numerical box and “One thousand and 00/100” on the line below the payee’s name.

How to write a check with change?

To write a check with change, include the cents in the numerical amount and write out the dollar amount in words followed by the cents as a fraction (e.g., 50.75 as Fifty and 75/100).

How do I write a check to myself for deposit?

Write the check to yourself by entering your name in the "Pay to the Order of" line, fill in the date, amount in numbers and words, and sign the check. Endorse the back and mark it for deposit.

Chase how to write a check?

To write a check for Chase, fill in the date, payee’s name, amount in numbers, amount in words, memo line (optional), and sign the check.

How to write 1400 on a check?

For a $1400 check, write “1400.00” in the numerical box and “One thousand four hundred and 00/100” on the line below the payee’s name.

How to write a check for 5000 dollars?

For a $5000 check, write “5000.00” in the numerical box and “Five thousand and 00/100” on the line below the payee’s name.

How to write a $100 check?

For a $100 check, write “100.00” in the numerical box and “One hundred and 00/100” on the line below the payee’s name.

How to write 2500 on a check?

For a $2500 check, write “2500.00” in the numerical box and “Two thousand five hundred and 00/100” on the line below the payee’s name.

How to write 400 on a check?

For a $400 check, write “400.00” in the numerical box and “Four hundred and 00/100” on the line below the payee’s name.

How to write 100 dollars on a check?

For a $100 check, write “100.00” in the numerical box and “One hundred and 00/100” on the line below the payee’s name.

How to write 90 on a check?

For a $90 check, write “90.00” in the numerical box and “Ninety and 00/100” on the line below the payee’s name.

How to write a wedding check?

To write a wedding check, enter the name of one of the newlyweds or the specified payee, fill in the amount, date, and your signature.

How to write a check for 600 dollars?

For a $600 check, write “600.00” in the numerical box and “Six hundred and 00/100” on the line below the payee’s name.

How to write a check for taxes?

When writing a check for taxes, make it payable to the appropriate tax authority, include your taxpayer identification number, tax year, and form number in the memo line.

How to write 750 on a check?

For a $750 check, write “750.00” in the numerical box and “Seven hundred fifty and 00/100” on the line below the payee’s name.

How to write money on a check?

To write money on a check, fill in the numerical amount in the box and write out the amount in words on the line below, including cents as a fraction if applicable.

Sample: how to write a check?

A sample check includes all the necessary elements: date, payee, amount in numbers, amount in words, memo (optional), and signature. For example, a check for $100 to “John Doe” would be written with “One hundred and 00/100.”

How to write a $500 check?

For a $500 check, write “500.00” in the numerical box and “Five hundred and 00/100” on the line below the payee’s name.

How to write 1600 on a check?

For a $1600 check, write “1600.00” in the numerical box and “One thousand six hundred and 00/100” on the line below the payee’s name.

How to write a check for 2500?

For a $2500 check, write “2500.00” in the numerical box and “Two thousand five hundred and 00/100” on the line below the payee’s name.

How to write a check for 75 dollars?

For a $75 check, write “75.00” in the numerical box and “Seventy-five and 00/100” on the line below the payee’s name.

How to write a check for 300?

For a $300 check, write “300.00” in the numerical box and “Three hundred and 00/100” on the line below the payee’s name.

How to write a check for 150?

For a $150 check, write “150.00” in the numerical box and “One hundred fifty and 00/100” on the line below the payee’s name.

How to write a cancelled check?

To cancel a check, write "VOID" across the front of the check in large letters. This prevents the check from being cashed or deposited.

How to write a check for $250?

For a $250 check, write “250.00” in the numerical box and “Two hundred fifty and 00/100” on the line below the payee’s name.

How to write a 1500 check?

For a $1500 check, write “1500.00” in the numerical box and “One thousand five hundred and 00/100” on the line below the payee’s name.

How to write a check for 1,000?

For a $1000 check, write “1000.00” in the numerical box and “One thousand and 00/100” on the line below the payee’s name.

How to write a check for $300?

For a $300 check, write “300.00” in the numerical box and “Three hundred and 00/100” on the line below the payee’s name.

How to write a check for 25 dollars?

For a $25 check, write “25.00” in the numerical box and “Twenty-five and 00/100” on the line below the payee’s name.

How to write a check for apartment rent?

To write a check for apartment rent, make it payable to your landlord or property management company, include the current date, rent amount in numbers and words, and note the rental period in the memo line.

How to write a check with zero cents?

If the check amount has no cents, write the whole number in the numerical box (e.g., 100.00) and write out the amount in words followed by “and 00/100” (e.g., One hundred and 00/100).

How to write a check for 1300?

For a $1300 check, write “1300.00” in the numerical box and “One thousand three hundred and 00/100” on the line below the payee’s name.

How to write void on a check?

To void a check, write “VOID” in large letters across the front of the check. This can be used to provide your bank account details for direct deposit setup without the risk of the check being cashed.

How to write out cents on a check?

To write out cents on a check, include the cents in the numerical amount and write the dollar amount in words followed by the cents as a fraction (e.g., 45.67 as Forty-five and 67/100).

How to write a check?

Writing a check involves filling out the date, payee’s name, amount in numbers, amount in words, memo line (optional), and signing the check.

How to write a check for 200?

For a $200 check, write “200.00” in the numerical box and “Two hundred and 00/100” on the line below the payee’s name.

How to write a check for 250?

For a $250 check, write “250.00” in the numerical box and “Two hundred fifty and 00/100” on the line below the payee’s name.

How to write cents in a check?

Include the cents in the numerical amount (e.g., 50.75) and write the dollar amount in words followed by the cents as a fraction (e.g., Fifty and 75/100).

How to write a check for 20 dollars?

For a $20 check, write “20.00” in the numerical box and “Twenty and 00/100” on the line below the payee’s name.

How to write a check for 800?

For an $800 check, write “800.00” in the numerical box and “Eight hundred and 00/100” on the line below the payee’s name.

How to write a check for $1500?

For a $1500 check, write “1500.00” in the numerical box and “One thousand five hundred and 00/100” on the line below the payee’s name.

How to write the date on a check?

Write the current date in the top right-hand corner of the check in the format MM/DD/YYYY (e.g., 07/02/2024).

How to write a check for 1500 dollars?

For a $1500 check, write “1500.00” in the numerical box and “One thousand five hundred and 00/100” on the line below the payee’s name.

Authors

Thomas M. A.

A literature-lover by design and qualification, Thomas loves exploring different aspects of software and writing about the same.

Hire the best without stress

Ask us how

Never Miss The Updates

We cover all recruitment, talent analytics, L&D, DEI, pre-employment, candidate screening, and hiring tools. Join our force & subscribe now!

Stay On Top Of Everything In HR