Financial Analyst Resume

Published on September 1st, 2024

A well-crafted resume can make all the difference when applying for a financial analyst position. As a financial analyst, you’ll need to demonstrate your ability to interpret data, create financial models, and communicate your findings to stakeholders. To craft a resume that highlights these skills, along with your qualifications and experience, is essential to standing out.

In this guide, we’ll walk you through the key components of a financial analyst resume, with free financial analyst resume templates and tips to ensure your resume gets noticed by hiring managers.

Introduction to the Financial Analyst's Role

A financial analyst plays a critical role in business environments by providing data-driven insights that influence strategic decisions and financial planning. At the core of a financial analyst's job description is the ability to evaluate financial data, prepare reports, and develop forecast models that help companies understand their financial outlook and make informed investment decisions. These professionals dive deep into market trends, financial statements, and investment portfolios to advise on potential financial risks and opportunities.

Financial analysts are typically segmented into various specialties—ranging from investment analysts, who focus on the stock market and investment opportunities, to budget analysts, who monitor institutional spending and forecasts. Regardless of their focus, the fundamental duties involve analyzing financial data, generating financial models, and providing recommendations based on their analyses to optimize financial performance and strategy.

Who is a Financial Analyst?

Financial analysts play a critical role in helping organizations make informed business decisions by analyzing financial data, creating reports, and forecasting financial trends. Whether you’re working for a large corporation, a small business, or a financial institution, your expertise guides strategic planning, investment decisions, and financial stability.

In finance, where precision and attention to detail are paramount, your resume must reflect these same qualities. A well-organized, thoughtfully crafted resume that highlights your skills, experience, and achievements will set you apart from other candidates. With the help of a strong resume, you can make a lasting impression that demonstrates your potential to employers.

This blog post will provide an in-depth look at how to create an effective financial analyst resume. From understanding the role and responsibilities to showcasing your skills, we will cover everything you need to craft a standout resume in the finance industry.

What do financial analysts do?

Financial analysts are pivotal in guiding companies through financial planning and market fluctuations, thanks to their expert analysis and strategic recommendations. A comprehensive understanding of their key responsibilities will enhance any financial analyst’s resume, as employers look for candidates who can demonstrate proficiency in specific areas of financial analysis.

Data Analysis: At the heart of a financial analyst's responsibilities is the analysis of financial data. This involves parsing data sets to identify trends, performing variance analysis, and using statistical techniques to forecast future performance.

Financial Reporting: Preparing detailed reports on financial performance is a regular duty. This includes quarterly and annual earnings reports, shareholder reports, and any ad hoc reports requested by management to support strategic decisions.

Investment Appraisal: Analysts often assess investment opportunities, using methods like Net Present Value (NPV) and Internal Rate of Return (IRR) to determine potential returns and advising on the viability of pursuing specific investments.

Budgeting and Forecasting: Developing financial models to predict outcomes and crafting budgets that align with strategic goals are crucial. This often involves working closely with various departments to ensure budgets are realistic and adhered to.

Stakeholder Communication: Financial analysts must communicate their findings and persuade stakeholders of their recommendations. This requires clear, impactful communication and a solid grounding in financial principles to effectively discuss findings with non-financial stakeholders.

By showcasing these key responsibilities on their resume, financial analysts can demonstrate their comprehensive expertise in financial analysis and their ability to contribute valuable insights to potential employers.

Pathways to Becoming a Financial Analyst

Becoming a financial analyst is a journey that requires a blend of education, certification, and strategic career steps. Here’s a streamlined pathway for those aspiring to enter this dynamic field:

Educational Foundation: A bachelor’s degree in finance, economics, accounting, or a related field is typically essential. This foundational education offers the critical thinking and technical skills necessary for the role.

Gain Relevant Experience: Internships or entry-level positions in banking, accounting, or finance provide practical experience and an understanding of financial markets, modeling, and analysis techniques.

Certifications to Boost Credibility: Obtaining certifications can significantly enhance your prospects. The Chartered Financial Analyst (CFA) credential is highly regarded in the industry and involves passing rigorous exams that cover a broad range of financial topics. Other relevant certifications include Certified Public Accountant (CPA) and Financial Risk Manager (FRM).

Specialize and Advance: As you gain experience, specialize in areas such as quantitative analysis, portfolio management, or risk management. Continuing education and advanced degrees, like a Master’s in Finance or an MBA, can also be beneficial.

Continuous Learning and Networking: Stay updated with the latest financial trends and technologies. Join professional organizations, attend industry seminars, and network with other professionals to find opportunities and advance your career.

By following these steps, candidates not only prepare themselves with the necessary skills and qualifications but also position themselves as attractive prospects to potential employers in the field of financial analysis.

Essential Skills for Financial Analysts

To thrive as a financial analyst, certain skills are critical for success:

Analytical and Critical Thinking Skills

Financial analysts must be able to assess data, identify patterns, and draw meaningful conclusions. Analytical and critical thinking skills allow you to make data-driven decisions that can have a lasting impact on the organization.

Proficiency in Financial Software and Tools

Proficiency with financial tools like Excel, SAP, and specialized financial modeling software is essential. These tools help streamline data analysis and reporting, making your work more efficient and accurate.

Communication and Presentation Skills

Being able to effectively communicate your findings is just as important as conducting the analysis itself. Financial analysts need to explain complex financial information in a clear, concise manner, whether through reports, presentations, or one-on-one discussions with stakeholders.

Attention to Detail and Accuracy

In the world of finance, even small errors can have significant consequences. Employers look for candidates who demonstrate impeccable attention to detail, ensuring that financial reports and analyses are accurate.

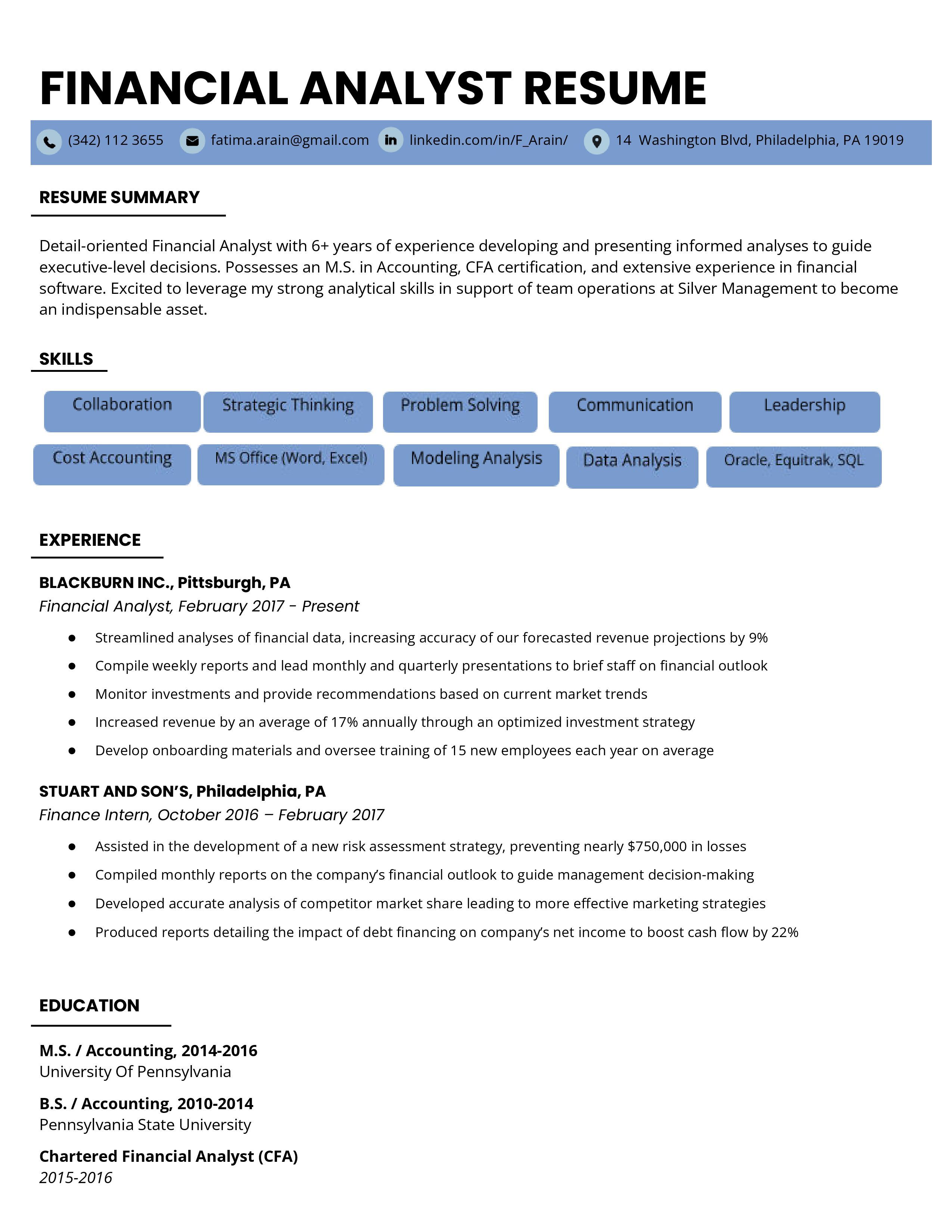

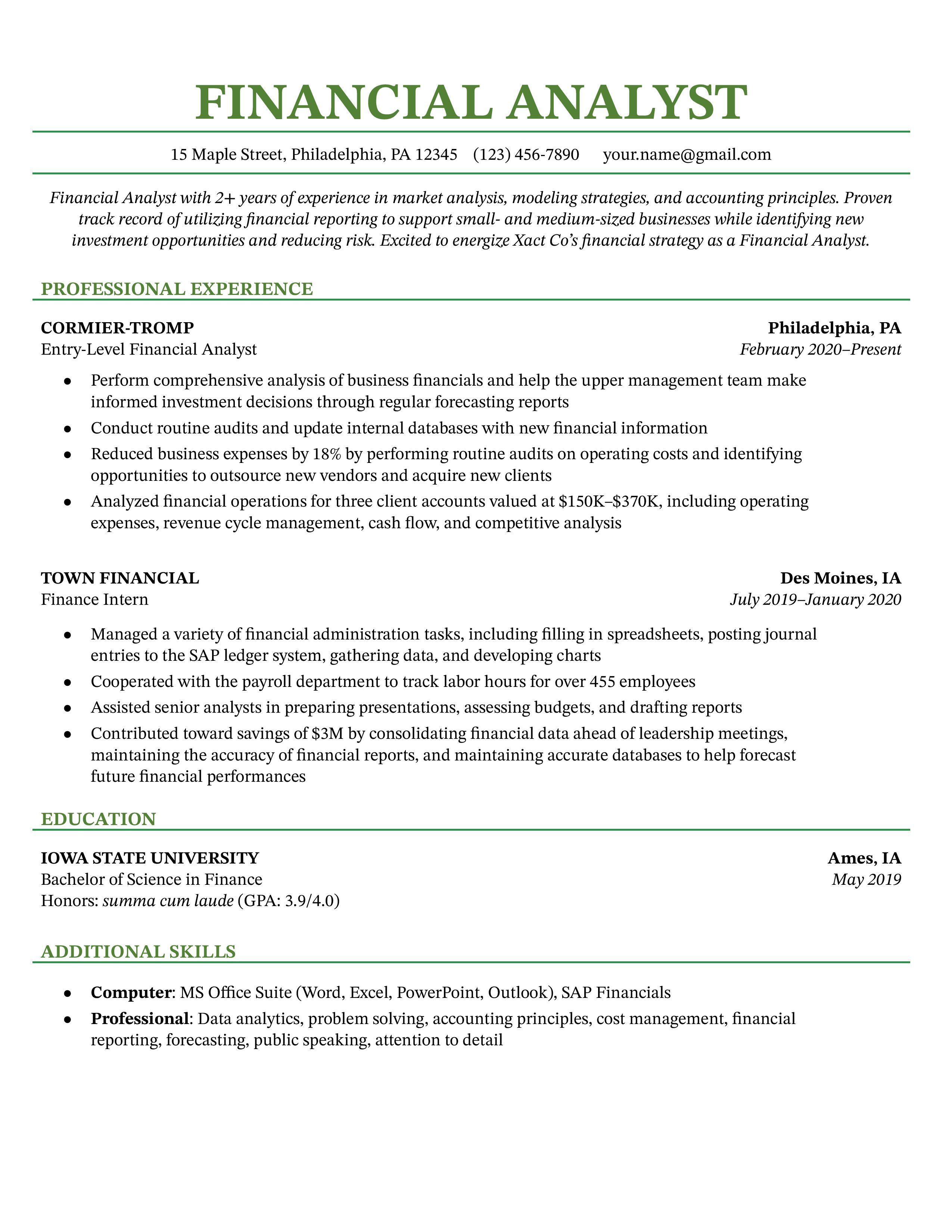

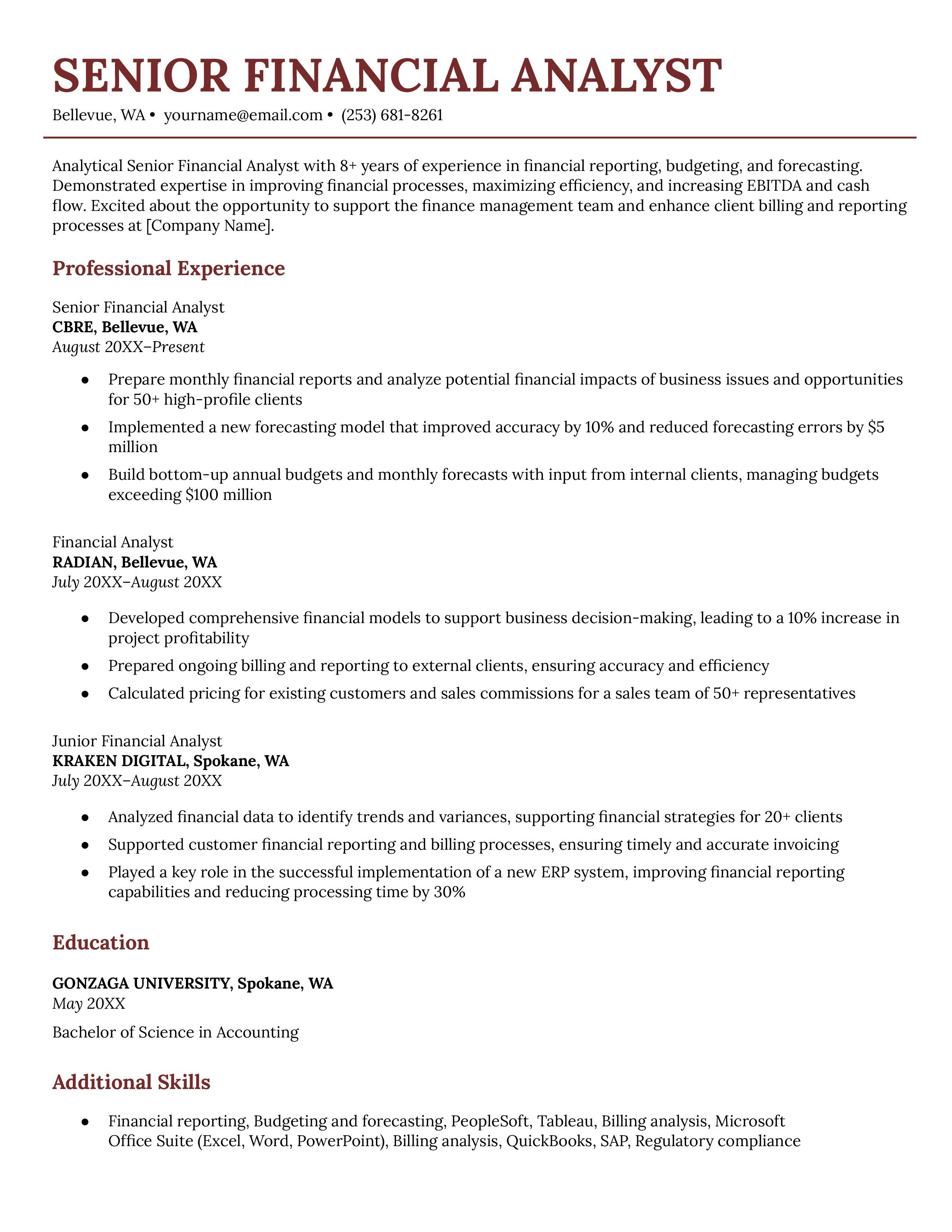

Resume Template Examples

When it comes to structuring your financial analyst resume, there are several formats to choose from. Each format highlights different aspects of your career, so it’s important to select one that best suits your experience.

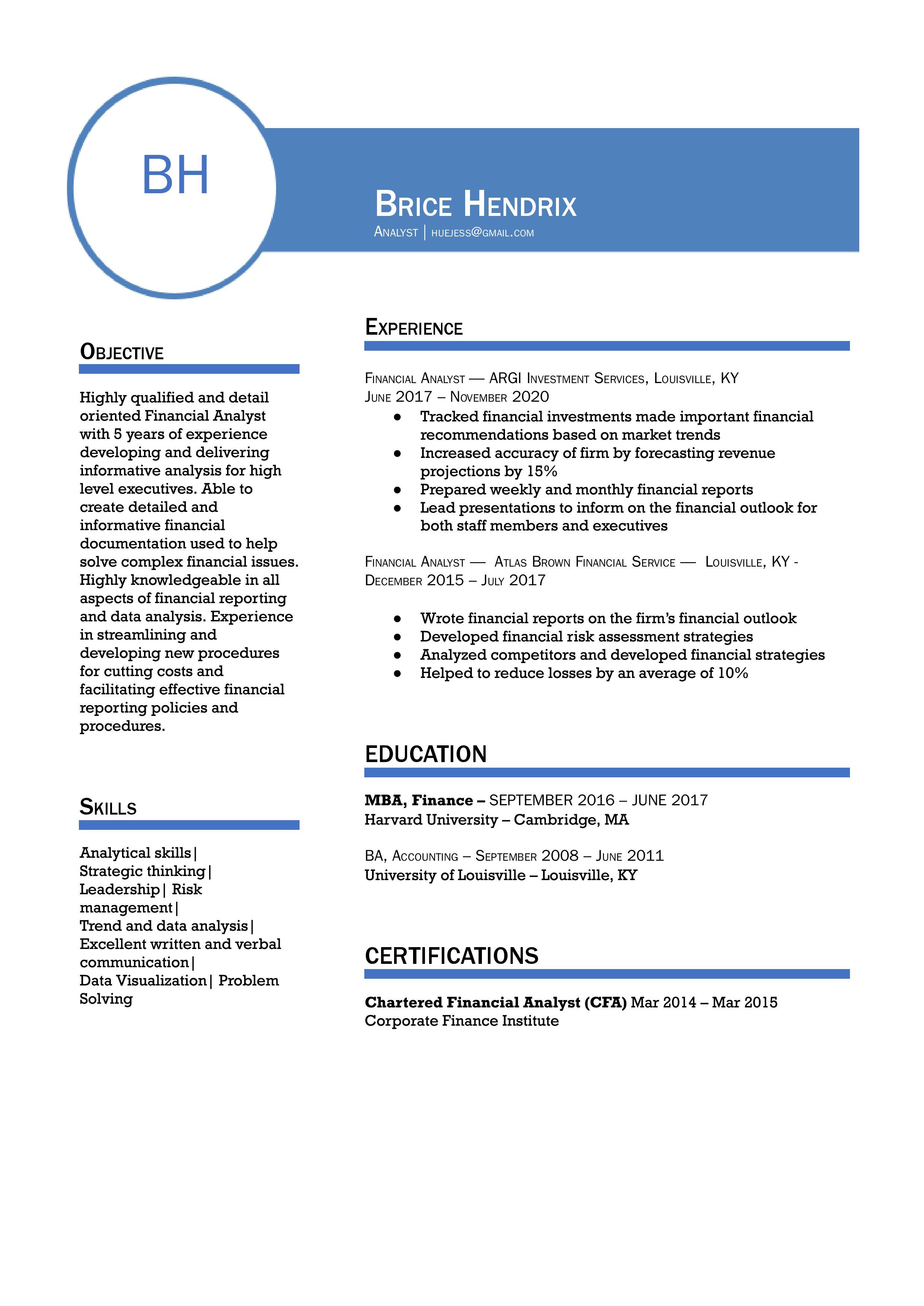

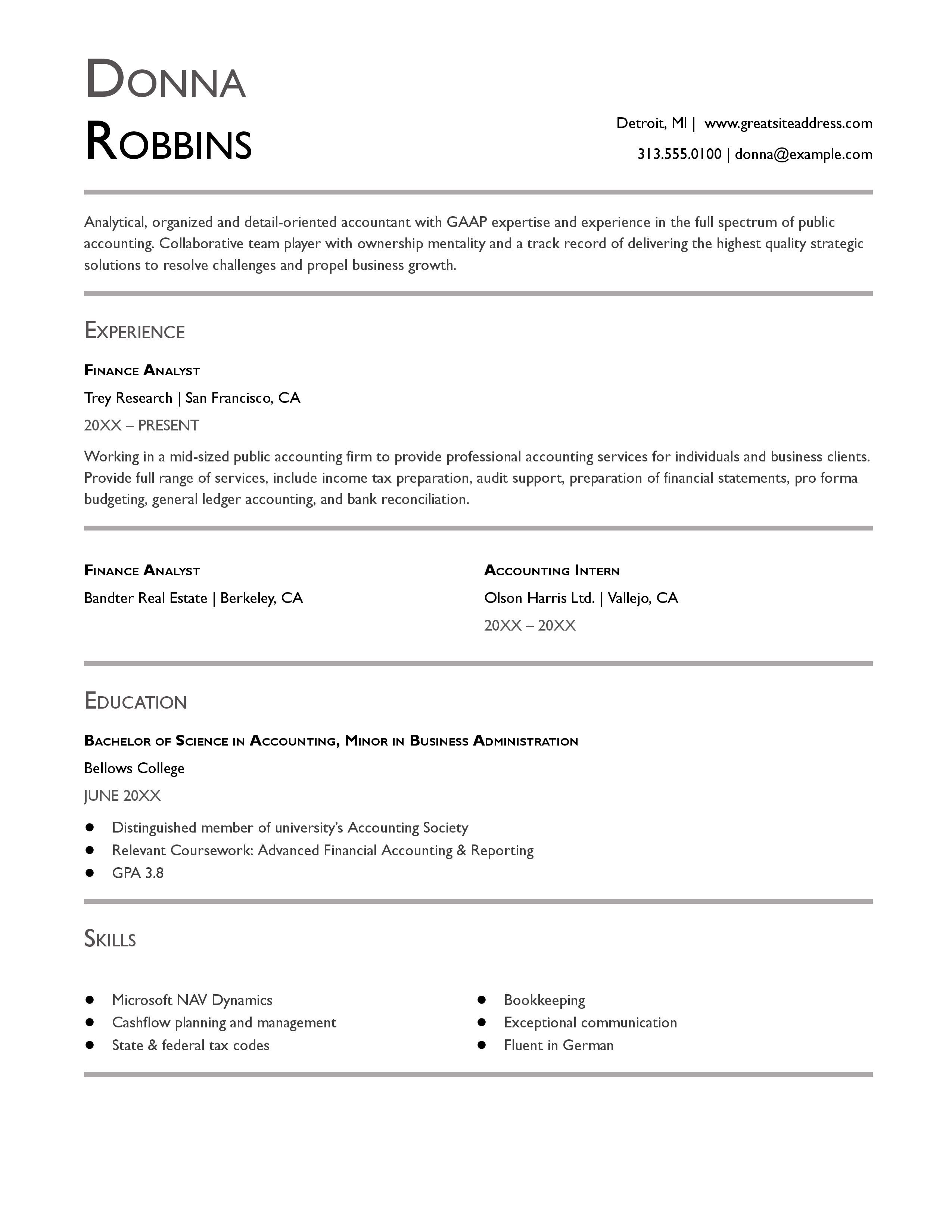

Template 1

How to Craft an Effective Financial Analyst Resume

Each financial analyst role may require a different set of skills, experiences, or qualifications. Tailor your resume for each job you apply to by carefully reading the job description and aligning your resume with the key requirements. Use the same keywords and highlight relevant skills to make your resume stand out.

Your resume should be clear and easy to read. Use bullet points to break up text and focus on quantifiable achievements, such as “Increased annual revenue by 10% through improved budgeting processes.” A clean, professional layout will ensure that hiring managers can quickly identify your strengths.

Key Sections of a Financial Analyst Resume

A. Contact Information

Include your full name, phone number, email address, and LinkedIn profile at the top of your resume.

B. Professional Summary or Objective Statement

A brief professional summary or objective should be placed at the top of your resume. This is your elevator pitch—use it to briefly describe your experience and career goals. For example: “Detail-oriented financial analyst with 5+ years of experience in financial modeling, budgeting, and data analysis.”

C. Work Experience

List your work experience in reverse chronological order. Focus on your accomplishments, not just your responsibilities. Include quantifiable achievements to demonstrate the impact of your work.

D. Education and Certifications

Include your educational background and any certifications, such as the CFA or CPA. Mention honors or notable coursework that may be relevant to the role.

E. Skills Section

List your technical and soft skills, such as financial modeling, data analysis, proficiency in financial software, and strong communication abilities.

Common Mistakes to Avoid

Overloading the Resume with Irrelevant Information

Keep your resume focused on the most relevant information. Avoid including details that don’t directly contribute to your candidacy as a financial analyst.

Using Jargon or Overly Complex Language

While it’s important to demonstrate your expertise, using too much industry jargon can alienate non-financial readers. Stick to clear, concise language that anyone can understand.

Neglecting to Proofread for Errors

Given the importance of accuracy in finance, even small typos or formatting errors can hurt your chances. Proofread your resume carefully and consider having a colleague review it as well.

Insight into Financial Analyst Salaries

Understanding the financial rewards of a career can be a significant motivator, and for financial analysts, the prospects are appealing. Salaries for financial analysts can vary widely based on geographic location, experience, and the specific sector in which they work.

- Entry-Level Salaries: Starting salaries for financial analysts typically range from $55,000 to $65,000 annually. However, entry-level positions in high-cost cities like New York or San Francisco may offer higher wages to accommodate the cost of living.

- Mid-Career and Senior Salaries: As financial analysts gain experience and move into mid-career or senior positions, their salaries can increase significantly. Mid-career professionals often earn between $70,000 and $90,000, while senior analysts can see salaries well over $100,000, especially in competitive industries or with specialized skills.

- Geographical Variations: Salary can also differ dramatically based on the location. Analysts in major financial centers such as New York City, London, or Hong Kong tend to earn more than their counterparts in smaller cities or less economically diverse regions.

- Future Outlook: The demand for financial analysts is expected to grow steadily as economic complexity increases and as businesses and investors require more sophisticated financial guidance and analysis. This growth suggests not only stable job security but also potential for salary increases as competition for skilled analysts grows.

Understanding these salary dynamics can help prospective financial analysts set realistic career expectations and provides current professionals with benchmarks for negotiating raises or considering job changes.

Resume Formatting Tips for Financial Analysts

The way a resume is formatted can significantly impact its effectiveness, especially in fields like financial analysis where details and precision matter. Here are some tailored tips to ensure your resume stands out in the competitive financial industry:

- Clear and Professional Layout: Opt for a clean, professional layout with clear headings and a logical flow. Use bullet points to break down complex information and make the resume easy to skim.

- Emphasize Key Skills Early: Start with a strong profile or summary that highlights your key skills in financial analysis, such as quantitative analysis, forecasting, and data interpretation. This section should catch the employer's attention immediately.

- Quantify Achievements: Whenever possible, quantify your achievements with specific figures and statistics. For example, "Improved financial model accuracy by 30% through refined forecast techniques," provides a concrete example of your impact.

- Highlight Technical Proficiencies: Make sure to clearly list your proficiency with financial analysis tools like Excel, SAS, or SQL, and any financial modeling software you are skilled in. This section can be a separate 'Technical Skills' list for clarity.

- Tailored Experience Section: Organize your experience section so that it reflects the requirements of the job you are applying for. Focus on roles and responsibilities that align closely with the typical duties of a financial analyst.

- Education and Certifications: Place your educational background and any relevant certifications, such as CFA or CPA, prominently. For financial analysts, these are often critical hiring criteria.

- Use Action Verbs: Start bullet points with action verbs like analyzed, developed, forecasted, and managed to convey a proactive, results-oriented approach.

By adhering to these formatting tips, financial analysts can craft a resume that not only looks appealing but also highlights their analytical skills and professional accomplishments effectively.

A strong resume is essential for standing out in the competitive finance industry. By highlighting your relevant skills, experience, and achievements, you can show potential employers that you are the best candidate for the job.

Use the tips and resume templates provided in this guide to craft a resume that clearly communicates your value to potential employers. Tailor your resume to each job, and focus on your most relevant skills and accomplishments.

The finance job market is highly competitive, but with a well-crafted resume, you can increase your chances of landing an interview. Take the time to create a resume that showcases your expertise, and you’ll be well on your way to securing your next financial analyst role.

Authors

Soujanya Varada

As a technical content writer and social media strategist, Soujanya develops and manages strategies at HireQuotient. With strong technical background and years of experience in content management, she looks for opportunities to flourish in the digital space. Soujanya is also a dance fanatic and believes in spreading light!

Hire the best without stress

Ask us how

Never Miss The Updates

We cover all recruitment, talent analytics, L&D, DEI, pre-employment, candidate screening, and hiring tools. Join our force & subscribe now!

Stay On Top Of Everything In HR