Accounts Payable Resume

Published on September 8th, 2024

Accounts payable and accounts receivable employees play a key role in the financial operations of a company and digital realm. Receiving incoming invoices, it enables follow through to pay bills before due dates to avoid any late fees from vendors, and keep all company's financial records current. It doesn't matter whether you're just beginning to work in accounts payable or have been working with companies for years; your resume says a lot about how you will take care of accuracy to meet deadlines and handle the very-important business relationships with the vendors.

We will break down in this blog how to write an accounts payable resume that grabs the eye of employers and assists you with finding your next job.

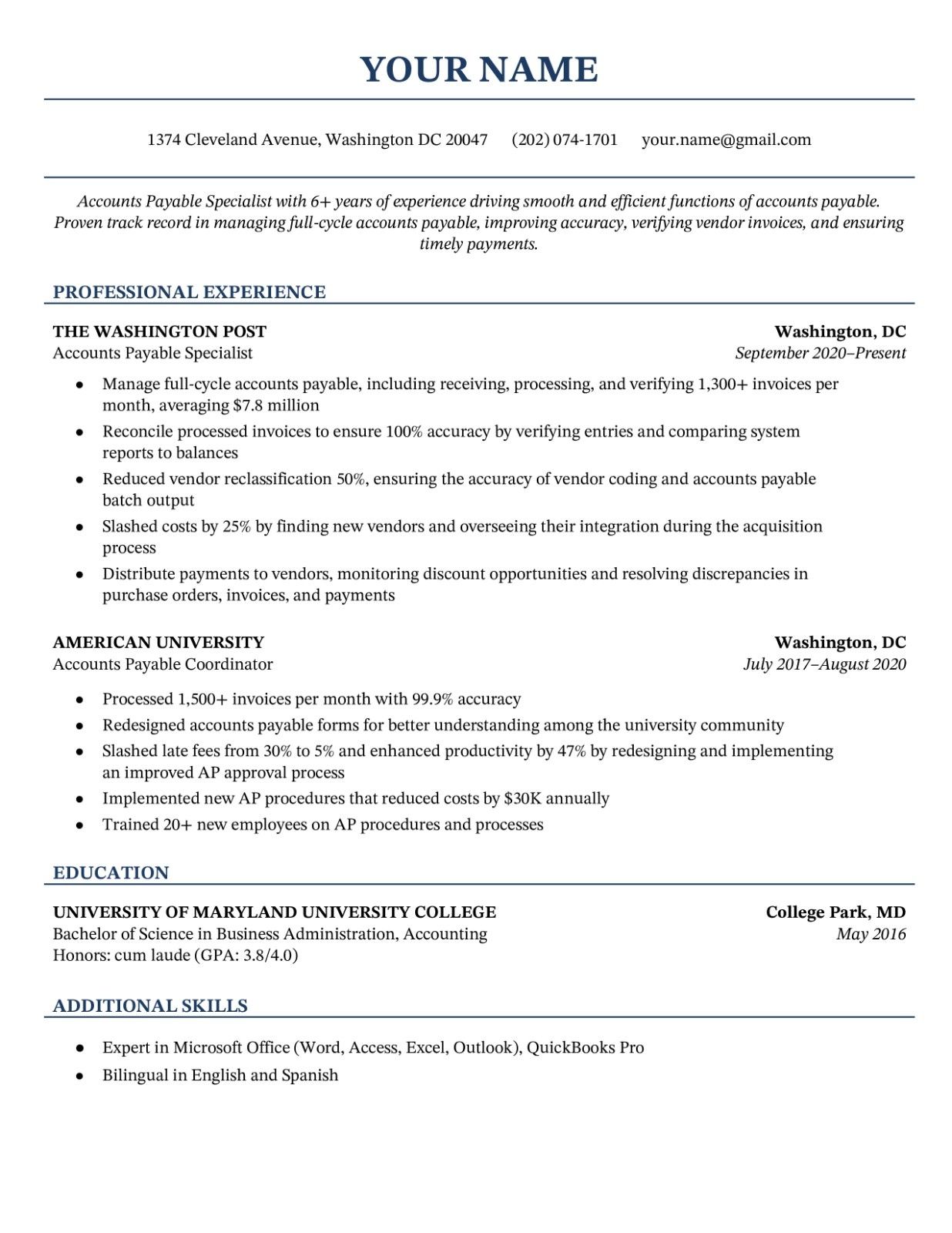

Check out this example of a template for accounts payable resume.

Craft a Professional Format

Your accounts payable resume format should be clear, professional, and user-friendly. A job for accounts payable demands strictness and attentiveness to detail, hence your account payable resume should portray this clearly. The format chosen should be basic reverse chronological highlighting work experience in reverse chronological order focusing on the current one.

Here is the outline for a resume.

- Contact Information

- Professional Summary

- Key Skills

- Work Experience

- Education

- Certifications (if necessary)

Keep the design clean; your fonts will be clear such as Arial or Calibri, and use bullet points for easy readability of the information.

Create a Compelling Summary

A professional summary is that short introduction that allows you to showcase the relevant skills and experience. This happens to be the first section employers scan, so consider it as a "killer" opener. Tailor this section for each application and pay more attention to the most relevant skills and accomplishments.

Read: Business analyst resume

Example

"For accounts payable specialists with experience of 4 years or more, processes and coordinates the flow of invoices and reconciles payments to multiple vendors. Demonstrated success with an improvement of 15% in discrepancies as a result of process improvements and consistently paid on time. Skilled user of QuickBooks and SAP. Seeking to leverage my expertise in financial operation at XYZ Corporation to ensure its operations are optimal and comply with the regulations.".

Keep your summary concise, three sentences at most, and with a focus on your strengths, especially related to the job being applied for.

Also read: Pilot Resume Templates

Convey Your Core Competencies

An account payable position entails a mix of technical and soft skills. Ensure you attach a section that shall outline your core competencies, especially those that align with your application advertisement.

Core Competencies in an Account Payable Resume

- Handling Invoices

- Reconciliation of payments

- Vendors' management

- General ledger

- Closing process for month and year

- Proficiency with accounting software: QuickBooks, SAP, or Oracle

- Attention to detail

- Time and organizational skills

- Data entry accuracy

- Accounts payable knowledge and regulation

Based on the job you are applying for, adapt your skills section to highlight the software or tools you are proficient in that are named in the job posting.

Describe Your Work Experience

Your work experience should reflect your core responsibilities and accomplishments yielded while working in previous accounts payable positions. Just don't list the job functions but describe what you accomplished in each position. Use numbers as much as possible when describing your achievements (e.g., fewer mistakes, higher processing rate).

Example:

Accounts Payable Specialist – ABC Corporation

Location – April 2020 to Present

- Processed over 500 invoices per month for over 50 vendors within reasonable timelines to ensure there were errorless and timely payments

- Ensured reconciliation of payment differences with a reduction in invoice error rates of 20% from proper documentation of processes.

- Prepared regular accounts payable reports and furnished management with financial information.

- Performed month-end and year-end closing processes within deadlines

- Implementation of streamlined payment procedure and collaboration of procurement and finance departments reduce the time of payment processing by an average of 10%.

Add Your Education

While many accounts payable positions require little more than a high school diploma, it is always better to have a degree or certain certifications. Be sure to include the degree and any relevant certifications.

Example:

B.S. in Accounting XYZ University – 2016

Certifications:

Certified Accounts Payable Professional (CAPP)

Certified Bookkeeper (CB)

If you do not have a degree in accounting or finance, you should also take online courses or certifications that can enhance your credentials.

Certifications and Technical Skills

Certifications and knowledge of accounting software can help you stand out as a candidate. If you have experience with certain software applications or obtained certifications that indicate that you can apply your knowledge of accounting skills, you should list these skills under one category.

Examples of relevant certifications and skills:

- Certified Accounts Payable Professional (CAPP)

- Certified Management Accountant (CMA)

- Knowledge of QuickBooks, Oracle, SAP, or other accounting software

- Knowledge of Microsoft Excel including VLOOKUP and PivotTables

- ERP knowledge experience (e.g., NetSuite)

- Certifications like CAPP reflect your expertise in the accounts payable process, so the candidate will be more appealing to the employer

Tailor Resume for Each Job

One good way to make sure that your accounts payable resume stands out is by tailoring it towards every job you will apply to. Relevant keywords of the job posting, after careful reading, should be put into your resume. This may help your resume evade the ATS scan, a common application procedure before it hits the hands of a human applicant reviewer.

For instance, if the job profile says experience with ERP systems, be sure to highlight your exposure with similar systems in your work experience and skills sections.

Make it Perfect to Get Noticed

Accurateness in accounting careers is above all, which means a single spelling or grammatical mistake on your resume and it will not go well with it. Ensure you proofread the resume on its way out checking to eliminate possible spelling and grammar errors. Grammarly as well as a colleague should help you capture errors that you could have overlooked.

How to Build a Strong Accounts Payable Resume (Final Words)

Writing an effective accounts payable resume does seem so easy once you are familiar with how it should be laid out. Pay attention to the smallest details in a resume, maintain a clear structure and emphasize your accomplishments. Above, I have given you steps to follow, and sure enough you would be able to compose accounts payable resumes highlighting your strengths, proving you an expert, and letting you stand out to your future employers.

After all, every job is unique. As much as possible, customize your resume to the specific position you are applying for. With the right approach, your accounts payable resume can open the door to exciting new opportunities.

Authors

Tomsy Thomas

An aspiring writer with a desire of crafting lines with powerful words from what she learned and discovered from her surroundings.

Hire the best without stress

Ask us how

Never Miss The Updates

We cover all recruitment, talent analytics, L&D, DEI, pre-employment, candidate screening, and hiring tools. Join our force & subscribe now!

Stay On Top Of Everything In HR